IS-MP-PC model can be used to better understand the dynamic of Monetary Policy Dynamics.

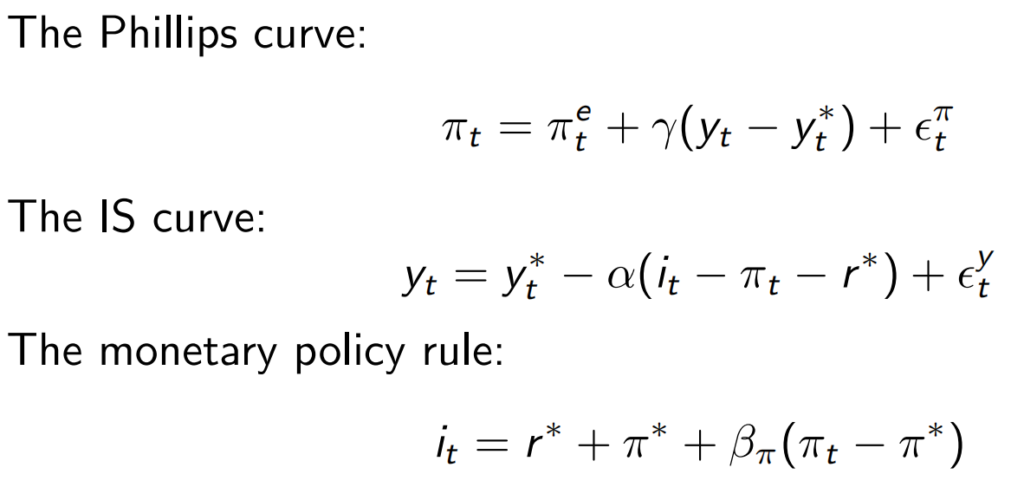

The model has three elements to it.

- A Phillips Curve: Describing how inflation depends on output.

- An IS Curve: Describing how outputs depends upon interest rates.

- A Monetary Policy Rule: Describing how the central bank sets interest rates depending on inflation and/or output

Putting three elements together we can get the IS-MP-PC model.

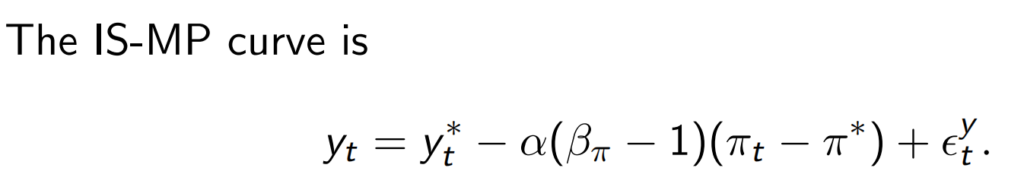

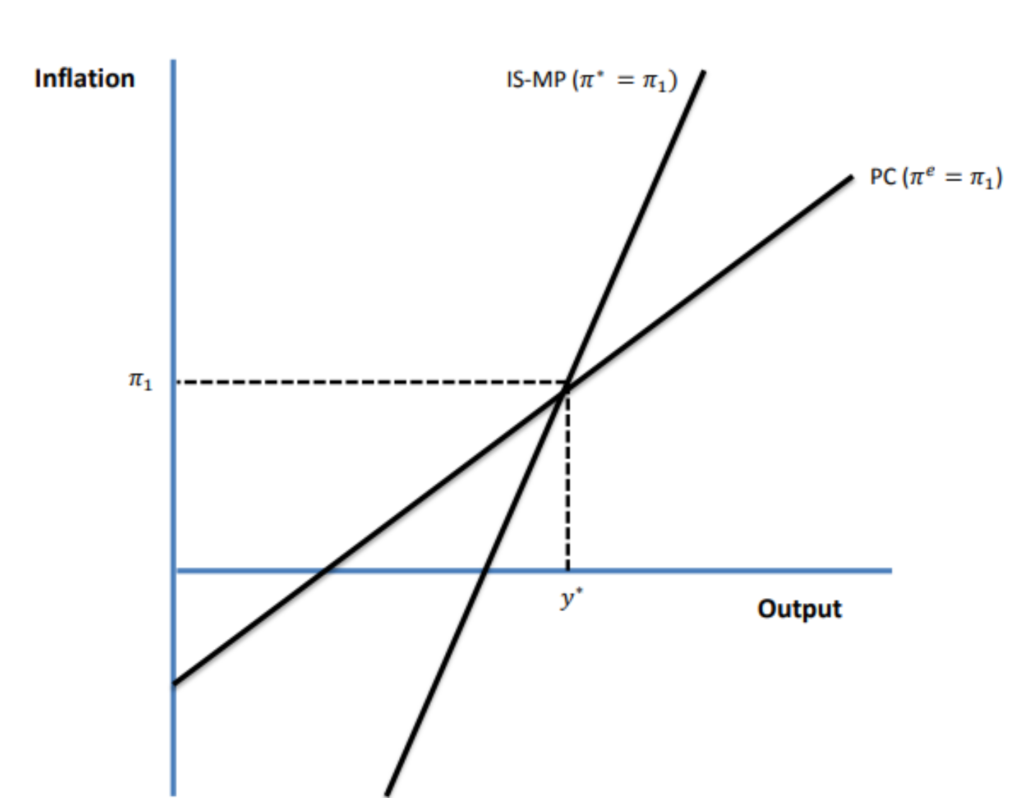

Substitutes Monetary Policy Curve into IS curve, you obtain the IS-MP curve:

If beta > 1 then increase in inflation lead to higher increase in norminal interest rate as shown on the MP curve, via the IS curve relation to lower output.

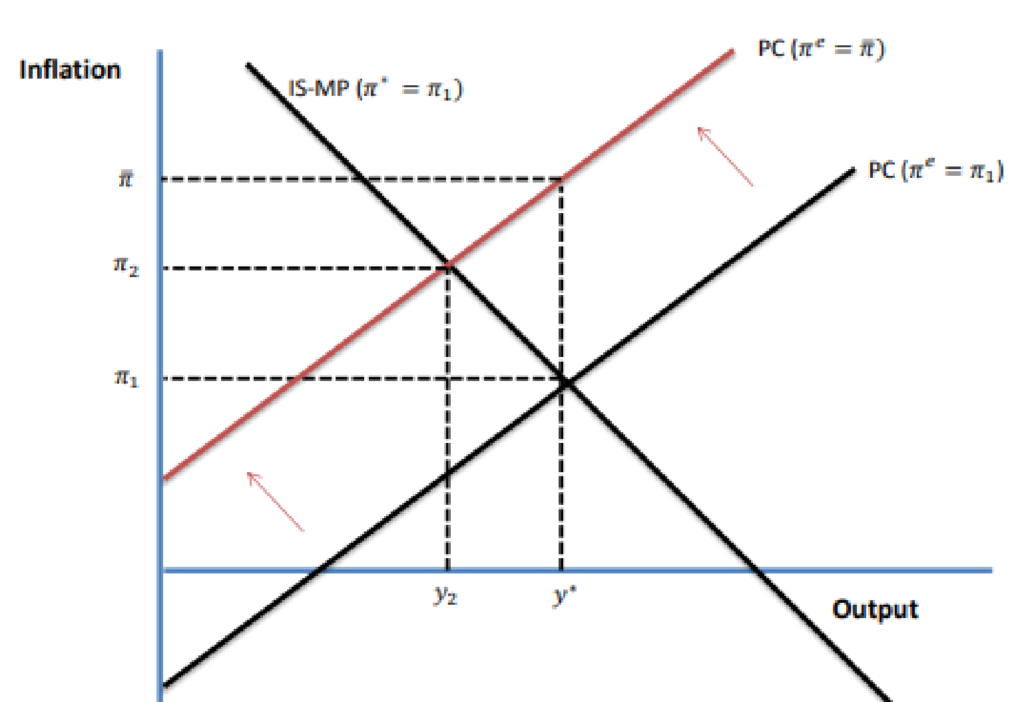

Why inflation expectation matters?

- Consider a case where inflation expectations shifts to being higher than the central bank’s inflation rate.

- After the increase in inflation expectations:

- The PC curve shift upwards

- Output ends up being lower than its natural rate

- Inflation rises, and ends up taking a value being the inflation expectation and targeted inflation

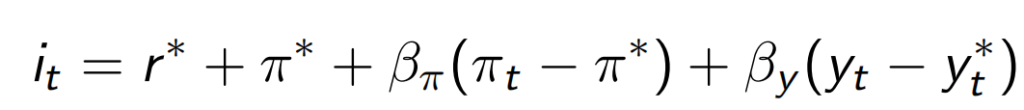

An alternative Monetary Policy Rule is Taylor Rule, where it assumes central bank adjust interest rates in response to both inflation and gap between output and an estimated trend.

Substitute the Taylor Rule into the IS curve, we get a new IS-MP curve:

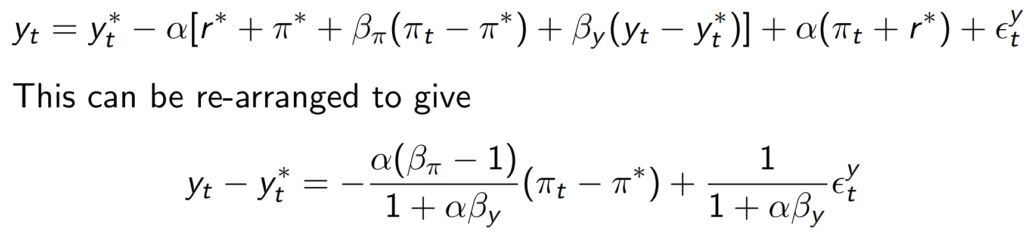

Substitute IS-MP curve into PC curve we get:

Let’s recap in what each greek letter means here:

- Gamma: how inflation changes when output changes (coefficient from the PC curve)

- Alpha: how output changes when real interest rate changes (coefficient from the IS curve)

- Beta: how central bank responds to inflation (coefficient from the MP curve)

There different cases depending different values of Beta:

- If Beta > 1:

- Then 0 < Theta < 1

- Central bank implement a bigger change in interest rate in relation to inflation

- In this case, inflation is mean reverting and will converge back to targeted inflation

- if Beta < 1:

- Then Theta > 0

- The inflation will be unstable, and diverging away from targeted inflation

- if Beta < (1 – (1/(Alpha * Gamma))):

- Theta < 0

- which seems a rather weired assumption, as in this case, the inflation expectation will negatively affect the inflation

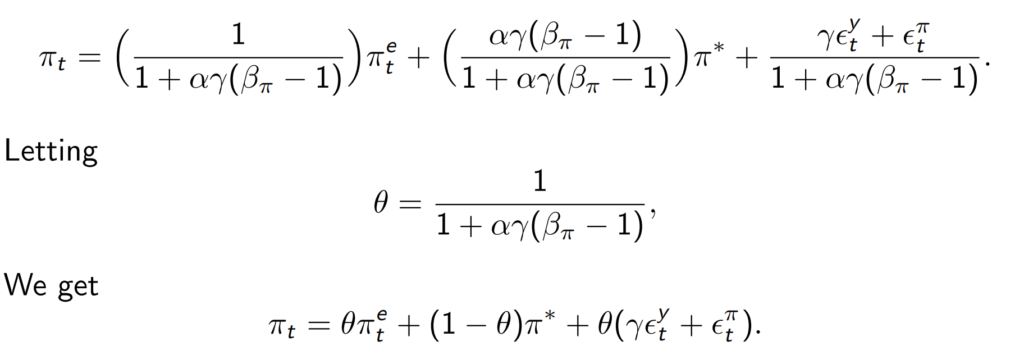

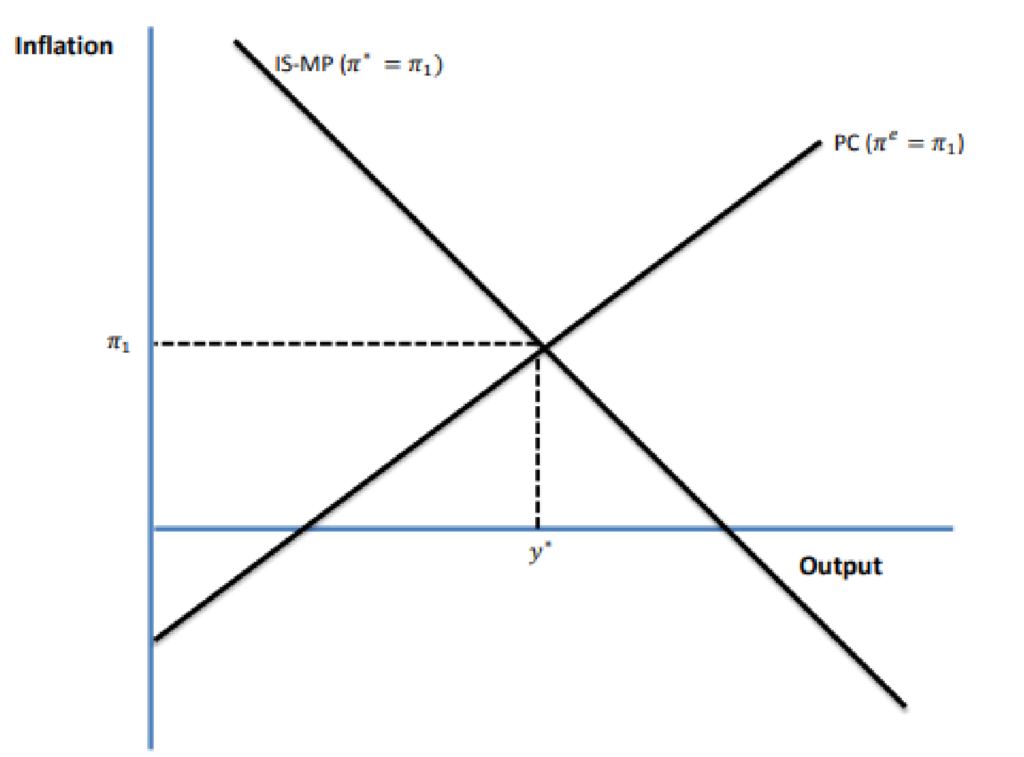

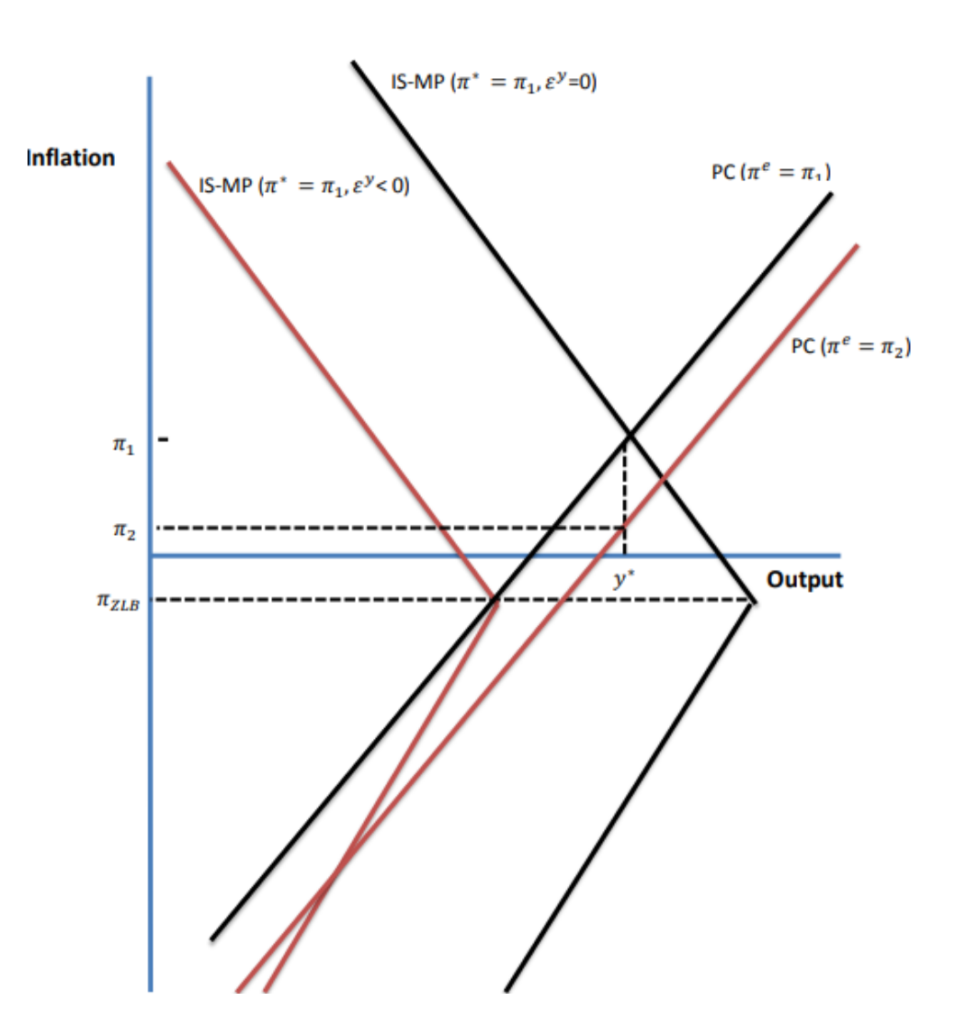

The IS-MP curve will be downward sloping when (Taylor Rule):

- 0 < Theta < 1

- or Beta > 1

The IS-MP curve will be upward sloping when:

- Theta > 1

- or Beta < 1

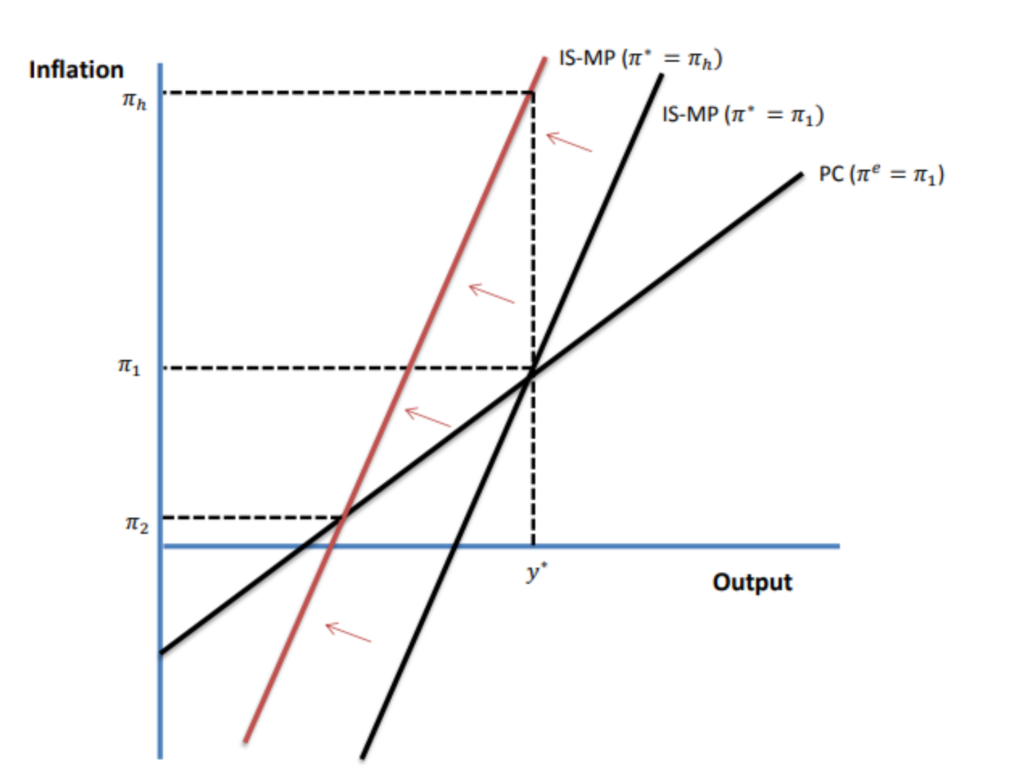

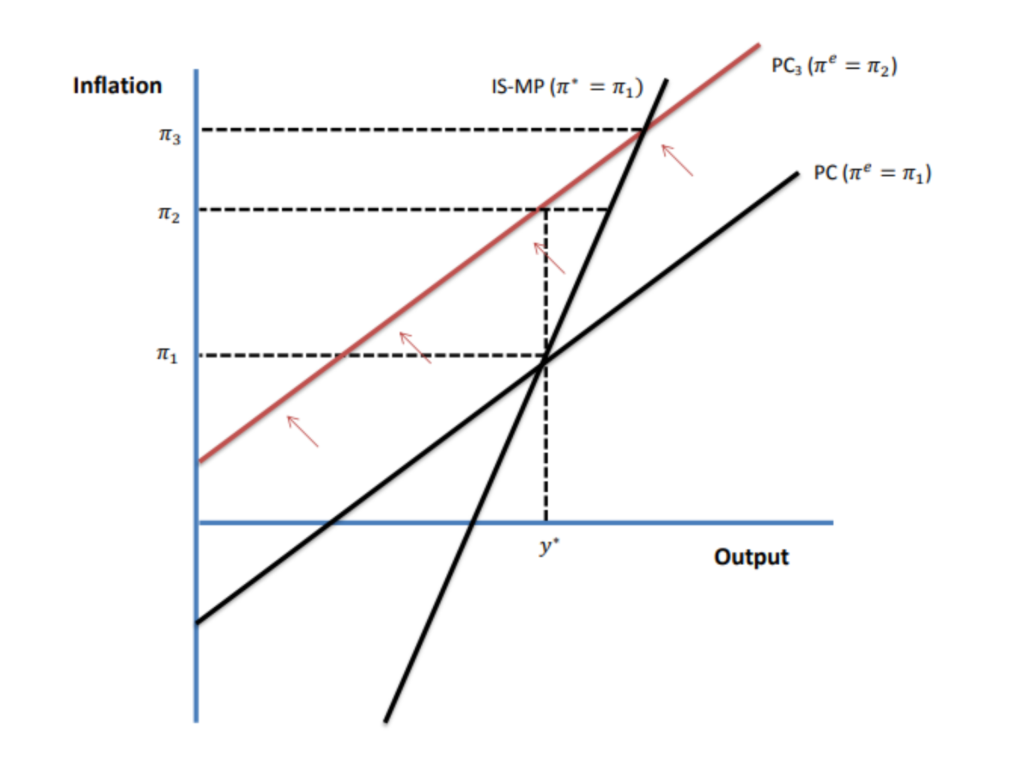

Dynamics:

An increase in targeted inflation shift the IS-MP curve to a lower output level at steady state.

An increase in the inflation expectation will shift the PC curve to a higher inflation level at steady state.

Evidence on Monetary Policy Rules and Stability:

- A paper titled “Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory” by Richard Clarida, Jordi Gali and Mark Gertler (QJE, 115(1), 2000, pp. 147-180).

- These economists reported that estimated policy rules for the Federal Reserve appeared to show a change after Paul Volcker was appointed Chairman in 1979.

- Post-1979 monetary policy appeared consistent with a rule in which the coefficient on inflation that was greater than one while the pre-1979 policy seemed consistent with a rule in which this coefficient was less than one.

- The paper also introduce a small model that shows how failure to obey the Taylor principle can lead to the economy generating cycles based on self-fulfilling fluctuations.

- They argue that failure to obey the Taylor principle could have been responsible for the poor macroeconomic performance, featuring the stagflation combination of high inflation and recession, during the 1970s in the US.

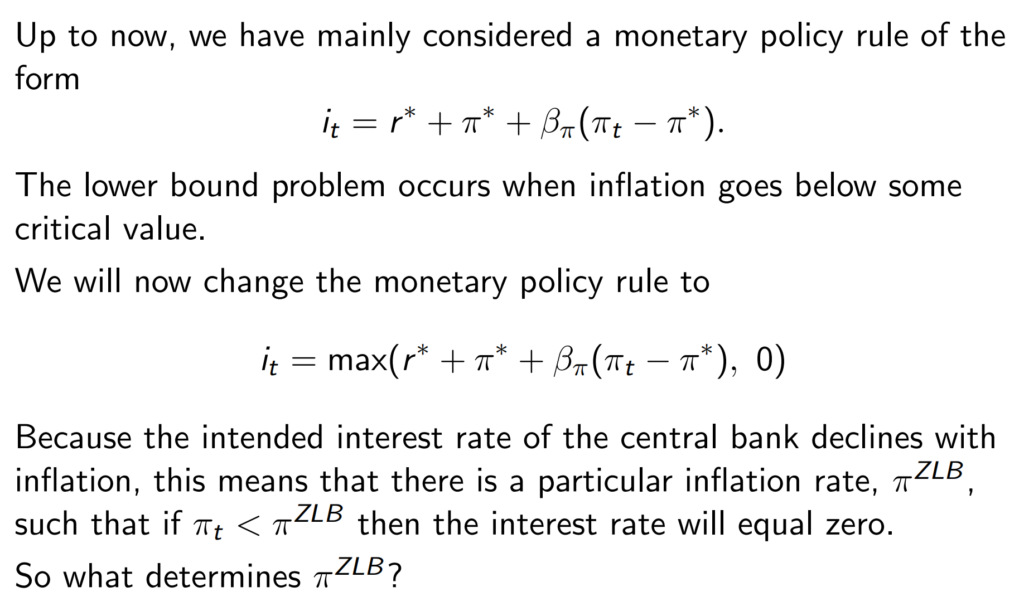

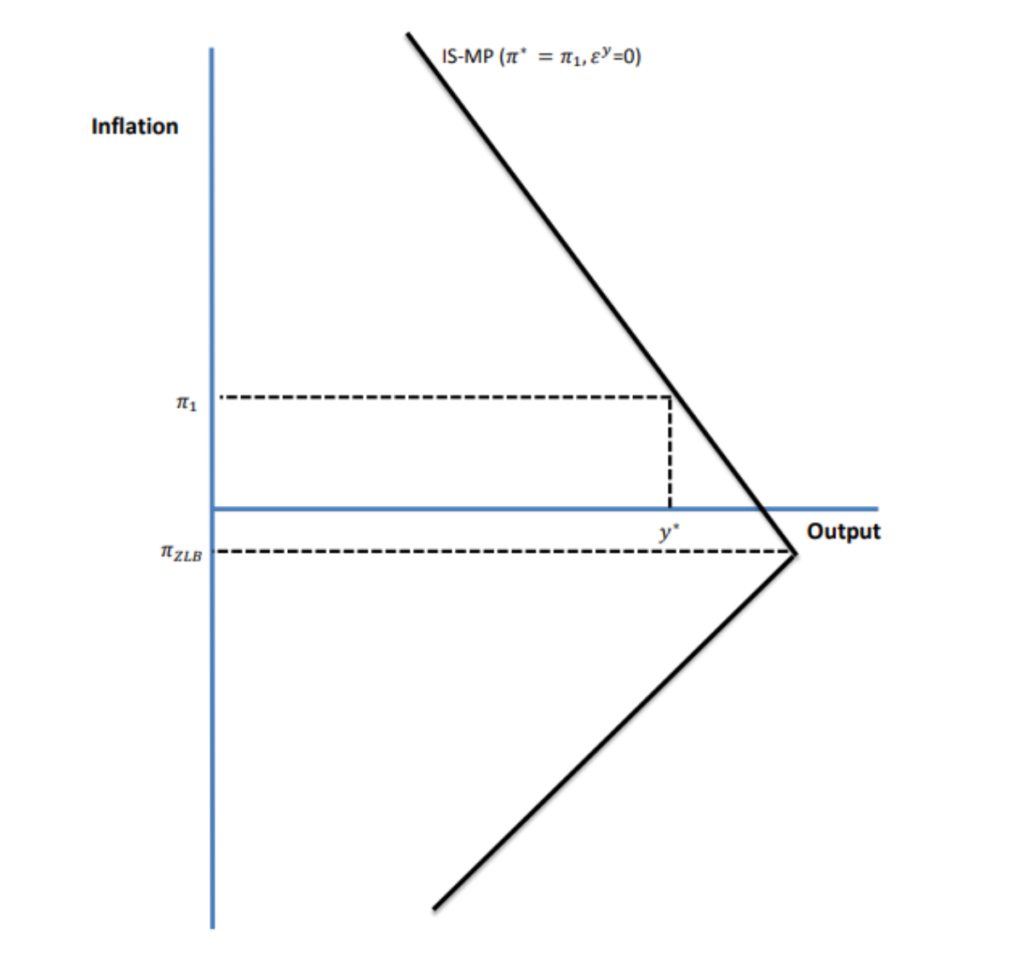

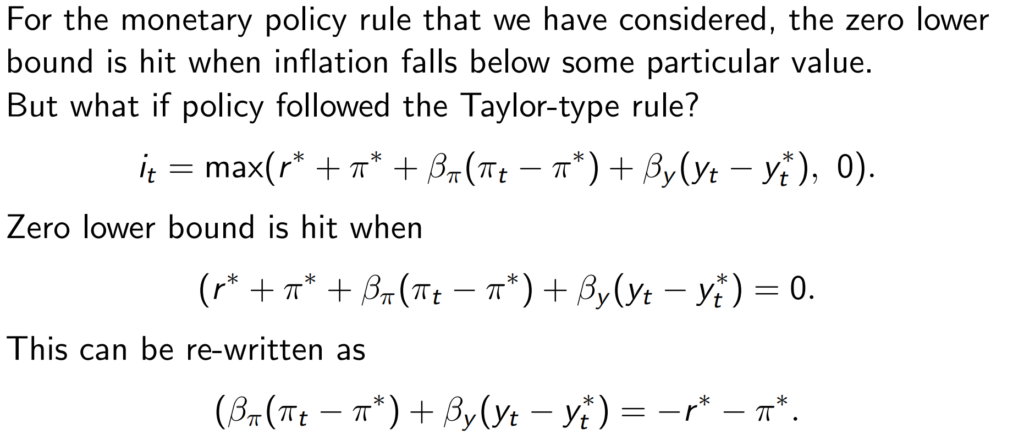

The Zero Lower Bound and the Liquidity Trap:

Can interest rate be negative?

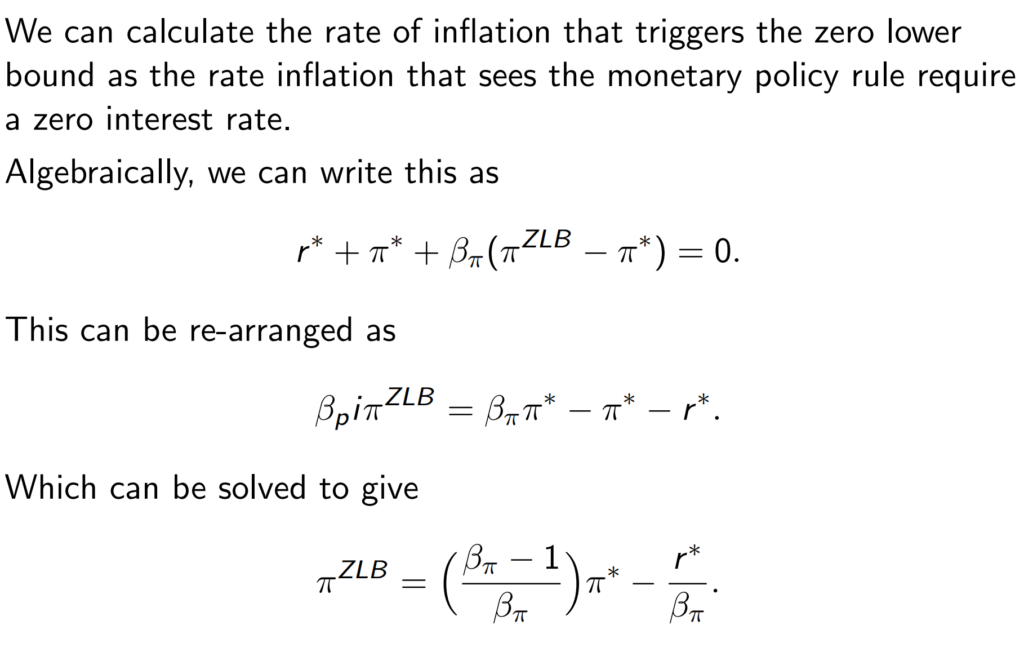

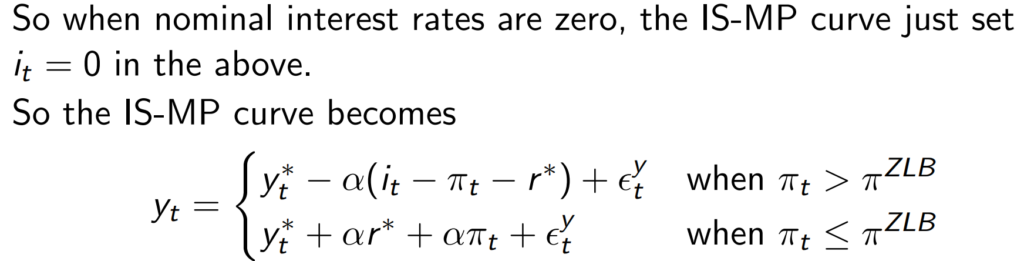

Zero lower bound holds if inflation is below this derived value.

Three factors determines this ‘trigger’ value of inflation:

- The inflation target: the higher the inflation target, the higher the level of inflation at which a central bank will be willing to set interest rate equal to zero

- The natural rate of interest: A higher value of r* lowers the level of inflation at which a central bank will be willing to set interest rates equal to zero. An increase in this rate makes central bank raise interest rates and so they will wait until inflation goes lower than previously to set interest rate to zero

- The responsiveness of monetary policy to inflation: Increase in Beta raise the first term bigger, and second term smaller (which has a negative sign); Both effects means higher beta translate into a higher value of Zero lower bound.

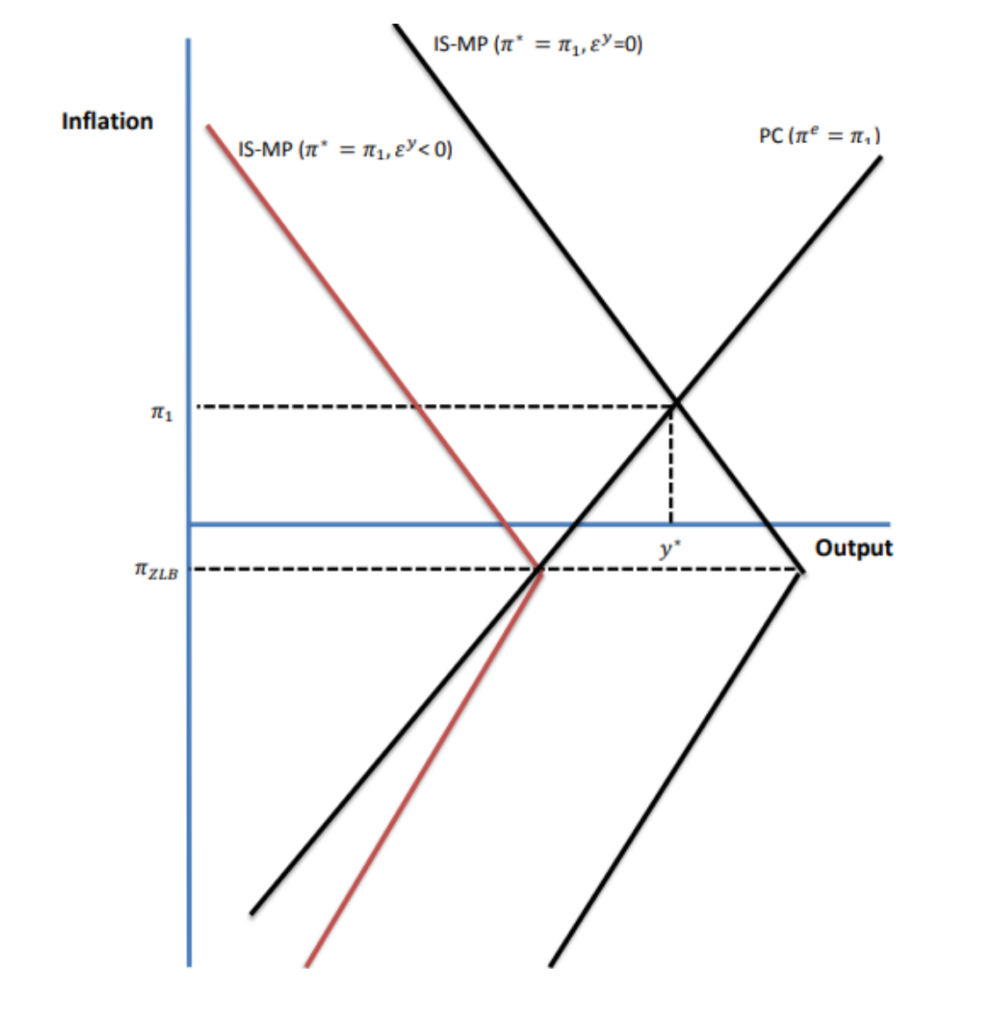

The IS-MP shifts from being downward sloping to being upward-sloping when inflation fall below Zero lower bound.

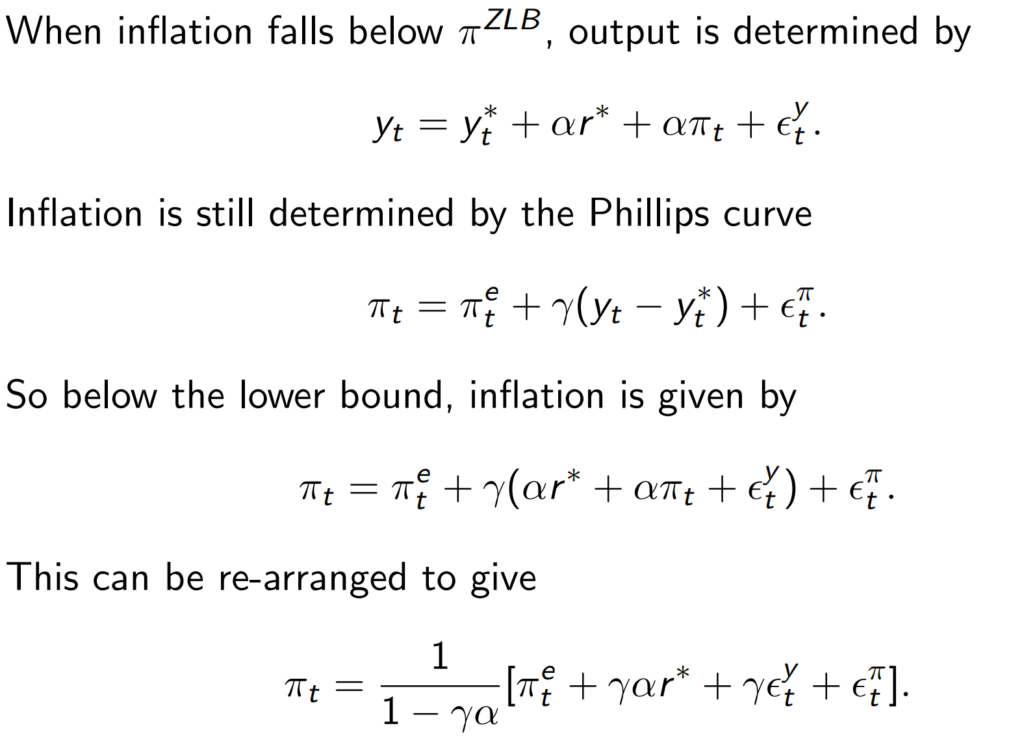

This final equation we derived is the inflation dynamics at the lower bound.

When there is a negative aggregate demand shock:

When falling expected inflation worsens slumps:

The liquidity Trap with a Taylor Rule

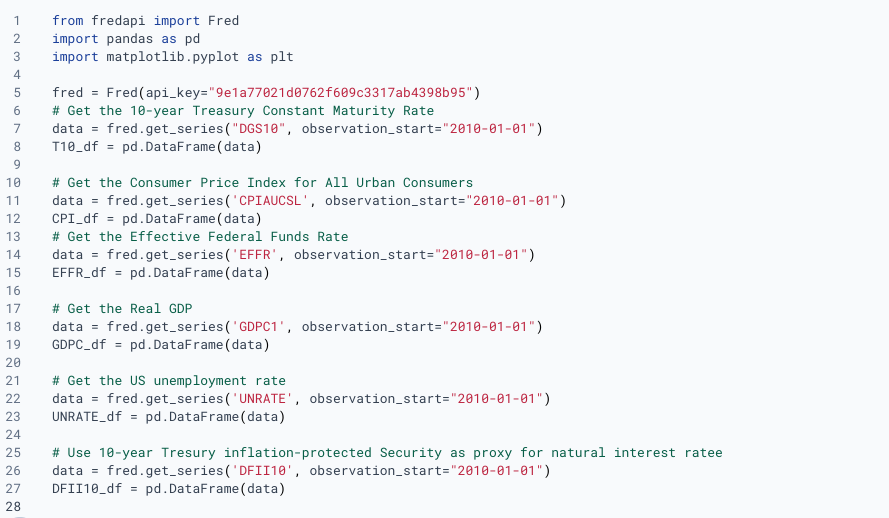

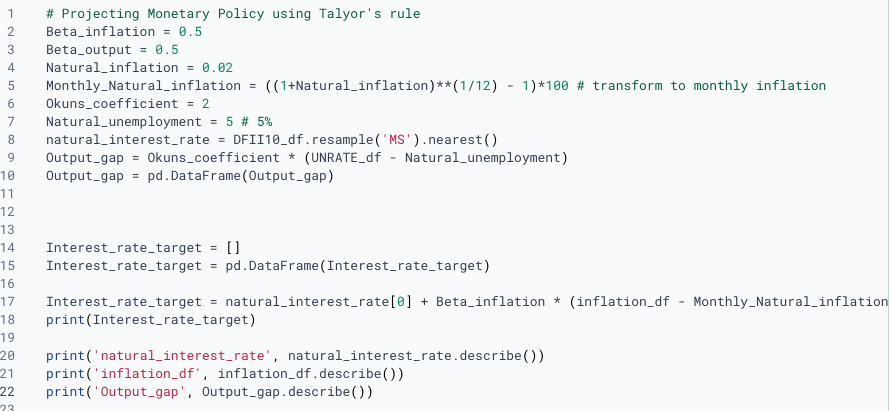

Python Project

Projecting targeted interest rate based on Taylor Rule

Leave a Reply