Option Greeks are a set of metrics that measure the sensitivity of an option’s price to various factors. They help traders and portfolio managers access and manage the risk associated with options.

Delta: Sensitivity to Underlying Price

Delta measures the rate of change of an option’s price with respect to changes in the price of the underlying asset.

Range: -1 to 1 for calls, and -1 to 0 for puts.

Example: A delta of 0.5 means the option price changes by $0.50 for every $1 change in the uderlying aaset.

Use: indicates how much an option’s price will move based on the underlying asset’s movement. It also approximates the probability of the option expiring in the money.

Applications: How to adjust Delta

- Increase Delta (Make portfolio more bullish):

- Buy Calls or Sell Puts (Remember that the call options have positive delta and puts have negative delta)

- Decrease Delta (Make portfolio more bearish):

- Buy Puts or Sell Calls

What is delta hedgeing? Delta hedging aim to make your portfolio ‘Delta Neutral,’ meaning small changes in underlying price will not have impact on portfolio value.

- Assume a strategy where you short the call and buy the underlying, which is known as Covered Call.

- If the prices of the underlying fall slightly, gain from the short call position offset the losses from the underlying.

Delta hedging with the underlying asset: You can also hedge the uderlying asset directly, as delta is always 1 for underlyings.

- Buy the Underlying: Increases positive delta.

- Sell the Underlying: Increases negative delta.

Gamma: Derivative of Delta

Gamma measures the rate of change of delta with respect to changes in the price of underlying asset.

How to calculate Gamma:

- It is the first derivative of Delta with respect to the price of the udnerlying asset.

- The second derivative of the option price with respect to the price of the underlying asset.

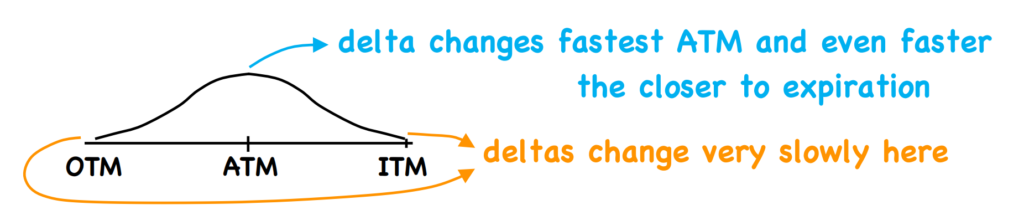

Ranges: Gamma for long option is always positive (no upper bound, with lower bound of 0) and short options is always negative(no lower bound, with upper bound of 0). (Regardless whether it is a call or put option) Gamma will be highest at the money, and geting close to zero when it gets deep in the money and out of money. Delta changes fastest at the money and even faster the closer to expiration.

Example: Suppose we are longing a call option at the strike price of $10

- Case 1: Assuming a spot price of $100, in this case, you are deep in the money. The delta of the call option approximately equal to 1. The gamma would be around 0. If the spot price decrease from $100 to 95$, the delta would not decrease much and price of the call option will not decrease much either.

- Case 2: However, if we assume the spot price is at $15, we are in the money but not deeply. Suppose the spot price drop from $15 to $10, the delta decreases faster as gamma is greater at the money. The call option price most likely will decrease significantly.

Uses: Helpful for analysing large price movements, and indicates how stable the option’s delta is.

Leave a Reply