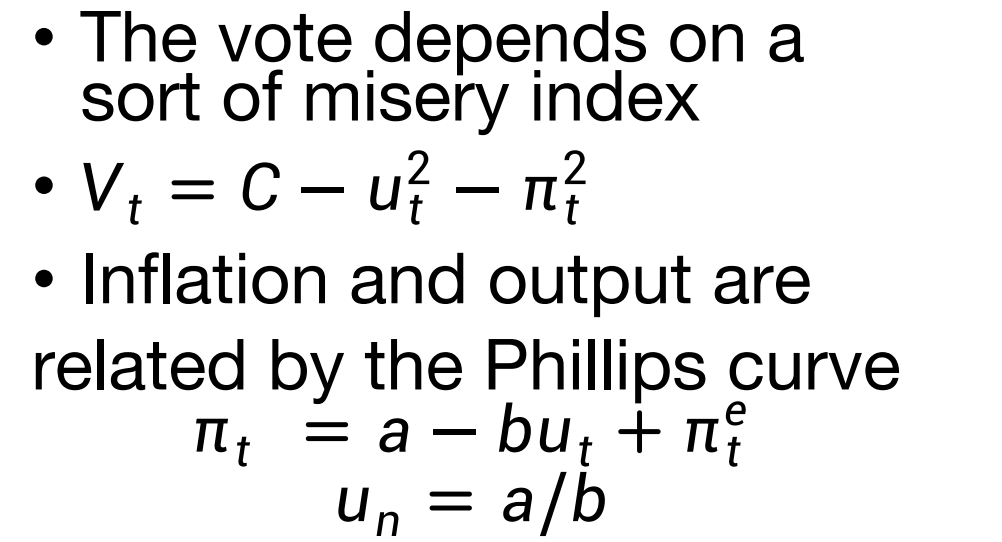

If monetary policy is not independent, the government may exploit inflation for vote gains, assuming unemployment in the short-run following the Phillips Curve.

Policy Invariance (New classical macroeconomics)

New classical macroeconomics affect norminal but not real variables

Demand deviates from long-run supply only if prices are different from what is expected. The implication is that neither monetary or fiscal policy can be used to stablise output systematically, and that therefore policy authorities should not attempt to use them.

Imperfect Wage and Price Adjustment

Policy invariance breaks down if wages and prices are not free to adjust to expected changes in the policy variable or other changes in demand.

Wages and prices may be set only intermittently (Calvo 1983)

- In the US three-year wage bargains are common. In the UK they are typically annual but have tended to cover longer period recently.

- There may be ‘menu’ costs to changing prices

- These developments have led to New Keynesian economics, to explore a situation where policy is effective even though people have rational expectations.

Sticky Prices

- Each firm set its price with reference to the general level of prices and to the level of demand.

- p = P + a(Y – YN)

- Some firms whose price is sticky set prices with reference to expectations of output and demand because they can not respond quickly to actual demand.

- Therefore, p = Pe + a(Ye – YN)

- Assume expected output is at its natural level, then

- p = Pe

If a fraction of firms are sticky

- suppose s is the fraction of firm have sticky price

- P = sPe + (1-s)[P + a(Ye – YN)]

- P = Pe + (1-s)a(Ye – YN)/s

- High expected price lead to actual prices

- a(1-s)/s is the slope of the Phillips Curve

- With different stickyness s, the PC slope changes

The importance of Expected Inflation

The government want to keep voter happy

- Inflation is stable only if expectations are fulfilled.

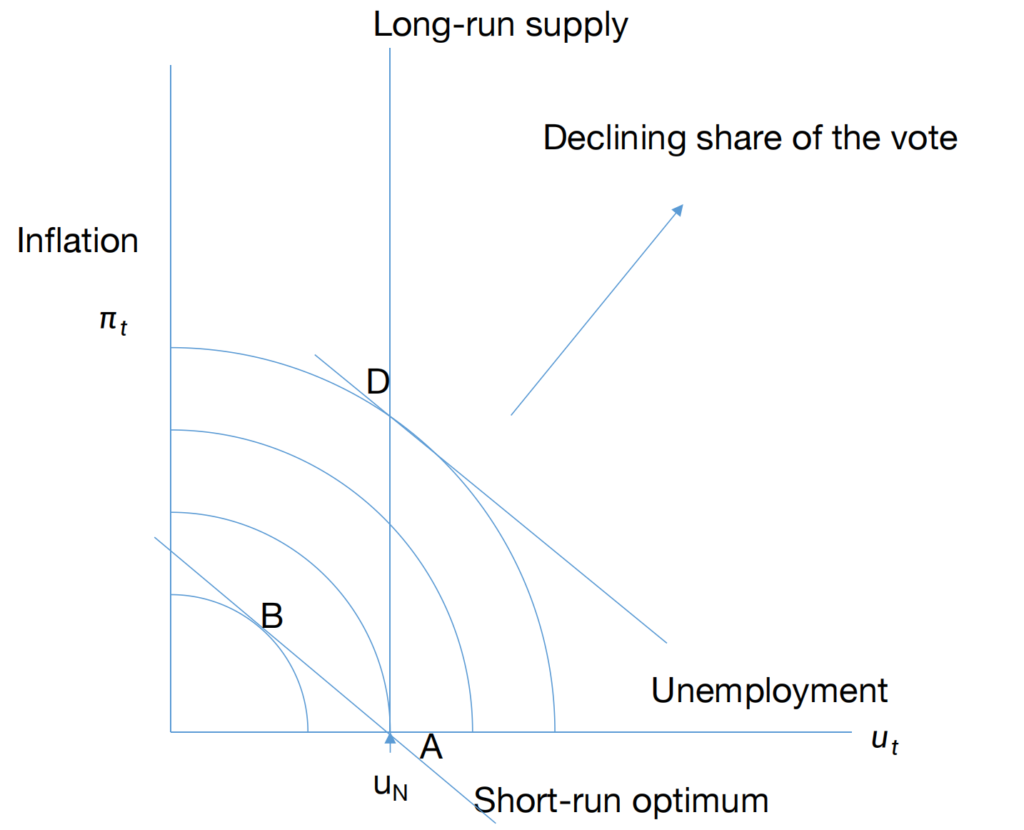

- The government has no incentive to deviate from expectations if the Phillips curve is tangent to the vote function.

- Expectations are fulfilled if unemployment is at its natural rate

- So the equilibrium is at the natural rate where the Phillips curve is tangent to the vote function.

- Pont A is now the government’s long-run preference

- B shows the optimum short-run policy

- So the private sector sets expected inflation at a level at which the government has no incentive to deviate

- It chooses the inflation rate at whcih the utility function in tangent to the Phillips Curve

Game Theory

- The government’s dominating strategy is to maximise vote count by pushing unemployment as low as possible.

- The private sector’s dominating strategy is to use its power on dictating inflation expectation.

- Point D is the Nash Equilibrium, however, it is pareto inefficient, because A can reduce inflation without sacrificing employment.

Outcome of Politics

- Point A is an equilibrium in that unemployment is at the natural rate.

- But if expectations do not changes, the government can gain extra votes by moving to B

- Expectation catch up a.nd unemployment returns to its natural rate with higher inflation point D.

- The government now gains votes by moving back to A.

- Flaw: the model assumes voters are irrational.

Policy in the long run

If the governent is playing a one-shot game: It would most likely inflate to receive more vote, meaning it does not care whether to run for a second term.

If the government is playing a repeated game, there will be two results:

- Inflate Now: Vote(Current period) > Vote(Discounted Sum of all future period)

- Don’t Inflate: Vote(Current period) <= Vote(Discounted Sum of all future period)

BoE Policy Framework

The BoE policy framework is based on the recognition that the actual inflation rate will on occassion depart from its target as a result of shocks and disturbances. Such factors will typically move inflation away from the target temporily. Attempts to undersirable volatility in output due to the short-term trade-offs involved, and the Monetary Policy Committee may therefore wish to allow inflation to deviate from the target temporaily.

Leave a Reply