There are four naked option strategies. You can combine them or / and with underlying stock for creating different payoff structure or for risk management purposes.

- Long Call

- Short Call

- Long Put

- Short Put

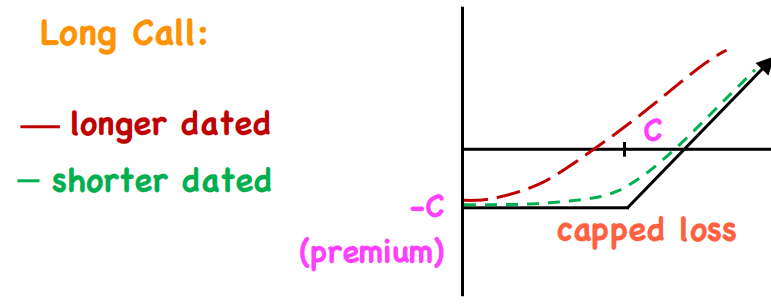

Long Call:

What does it do?

It gives you the right (but not the obligation) to purchase a underlying stock at your quoted price within a period (before expiration date). This quoted price is the strike price. If the spot price (i.e.: current market price) goes above the strike price, then you make money by exercising the call option.

Payoff:

Payoff a long Call (with premium) = Max (St – X, 0) – P

- St is the spot price of underlying stock at time t

- X is strike price at expiration date

- The lower boundary is capped at 0, because the when spot price is under the strike price, you can choose not to exercise the call.

Long Call has a capped loss at the cost of premium, the maximum gain is uncapped.

Payoff Dynamics:

The solid line with an arrow to the upper right represents the option payoff at its expiration. Notice the shorterdated to expiration call option (the one with shorter dash line) has payoff more closely aligned with with at expiration payoff than longer dated option.

You start to make money when gap between spot price and strike price is greater than the premium (S – X) > P

Option Greeks:

- Positive Delta: When the price of underlying increases, the price of the call option increases. As the call are more likely to be in the money, and therefore be exercised and matching a similar payoff of that of the underlying option. (As the more the option in the money, the more the delta get closer to 1)

- Positive vega: The increase in the underlying asset’s volatility increases the option value. When volatility increases, the range of the future price for the underlying stock widens. The greater uncertainity and fluction, increases the change that spot price went above strike price.

- Negative Theta: As expiration approaches, there’ less time for the underlying stock to move above the strike price. The price of an option consiists of two parts: Intrinsic Value and Time value. The time value decrease as expiration approaches.

When to use it?

When you are bullish on stock, and expect there is upward trend.

What is the limitation of this strategy?

- Be aware that the time decay can diminish your call option value, therefore, it is better to buy longer-dated options, as it time decay slower when further away from the expiration date.

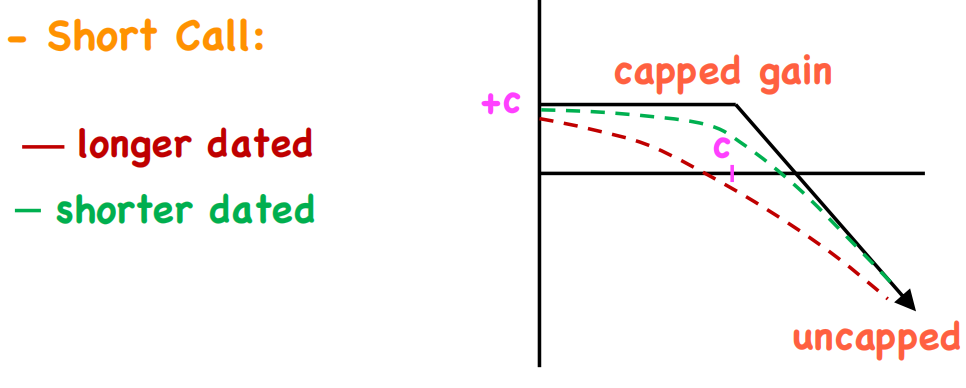

Short Call:

What does it do?

It gives you the Obligation (but not the right) to purchase a underlying stock at your counterparty’s quoted price within a period (before expiration date). You are paid a premium.

Payoff:

- Payoff of a Short Call = P – max (St – K, 0)

- Capped maximum payoff at the Premium you received. Uncapped downside loss.

Payoff Dynamics:

Notice that the shorter-dated short call also approximate the payoff of short call at the expiration date.

You are making money until the loss incurred by the difference between the spot price and strike price is greater than the premium. Profit Region: (S – X) < P

Option Greeks:

- Negative Delta: If the price of underlying increases, the call option become more valuable, which bad for you as a seller.

- Negative Vega: An increase in volatility increases the option’s premium, which is bad for you as a option seller.

- Positive Theta: As a option seller, you receive the premium upfront. Everyday that passes reduces the option’s time value, moving it closer to zero if it is not excised. This benefits you as a seller, as the option is cheaper to buyback.

When to use it?

Usually, a short call is used alongside with holding an underlying stock, to form a covered call. It gives you additional protection, as you earn a call premium to hedge against a possible drop in underlying stock price.

What is the limitation of this strategy?

- Naked short has very high risk and should not be used alone in most trading scenarios. Remember there is uncapped loss, therefore to use the short call, you have to be very bearish on the security.

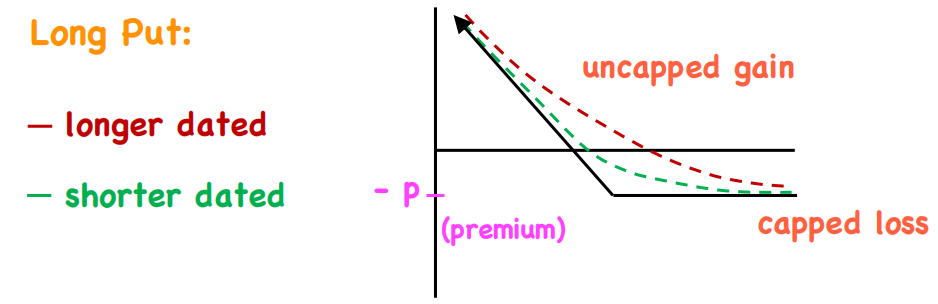

Long Put:

What does it do?

It gives you the right (but not the obligation) to Sell a underlying stock at your quoted price within a period (before expiration date). This quoted price is the strike price. If the spot price (i.e.: current market price) goes below the strike price, then you make money by exercising the put option.

Payoff:

- Payoff of a Long Put = Max (X – St, 0) – P

- There is a Theoratically uncapped gain, if spot price can go below zero.

- The is a capped lossed at your paid premium.

Option Greeks:

- Negative Delta: If the price of the underlying increases, the put option becomes less valuable, which is bad for you as a buyer.

- Positive Vega: An increase in volatility increases the option’s premium, which is good for you as a buyer.

- Negative Theta: As time passes, the option loses value due to time decay, which is bad for you as a buyer.

Payoff Dynamics:

When to use it?

- When you are bearish on the underlying market.

- It gives limit risk and high reward if the spot price goes below certain point

- Can be used alongside by holding an underlying security at the same time. This combined strategy is call a protective put, which is used to protect a stock position against losses. A protective put has a payoff of unlimited upside and limited downside risk capped at (S – X ) + P.

What is the limitation of this strategy?

- Time decay

- Limited profit potential: in reality, the spot price rarely become negative.

- May not work well if the premium is expensive, when market is volatile.

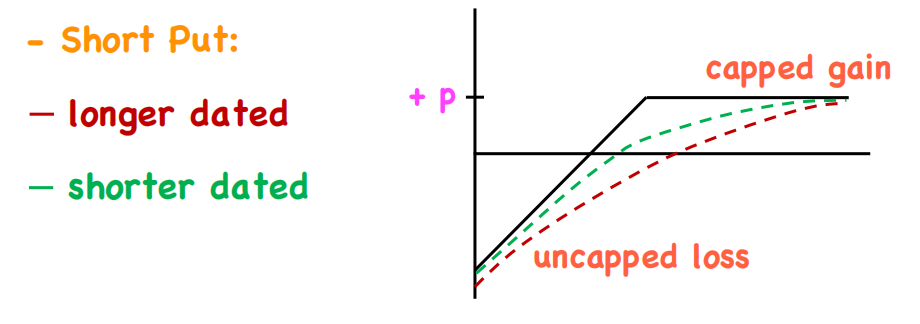

Short Put:

What does it do?

It gives you the obligation (but not the right) to sell a underlying stock at your counterparty’s quoted price within a period (before expiration date). This quoted price is the strike price.

Payoff:

- Price of a Call = P – Max (K – St, 0)

Payoff Dynamics:

Option Greeks:

- Positive Delta: If the price of the underlying increases, the put option becomes less valuable, which is good for you as a seller.

- Negative Vega: An increase in volatility increases the option’s premium, which is bad for you as a seller.

- Positive Theta: As time passes, the option loses value due to time decay, which is good for you as a seller because the option becomes cheaper to buy back or expires worthless.

When to use it?

- Slight Bullish, you use short put when you expect the stock price to stay the same or rise slightly.

- If the stock price stays above the strike price, the put will expire worthless, and you keep the premium as profit.

What is the limitation of this strategy?

- Limit profit, large risk; downside is great

- Not a good choice, when the market is extemely volatile.

Leave a Reply