-

To put it short, for a buy-side modeling, you have to know a little about everything. For sell-side, you have to know a lot about a particular industry or dozen firms. Sell-side: As a sell-side analysts your main goal is either for rating (Buy, Hold, Sell) or generating a price target. Here is the charateristics…

-

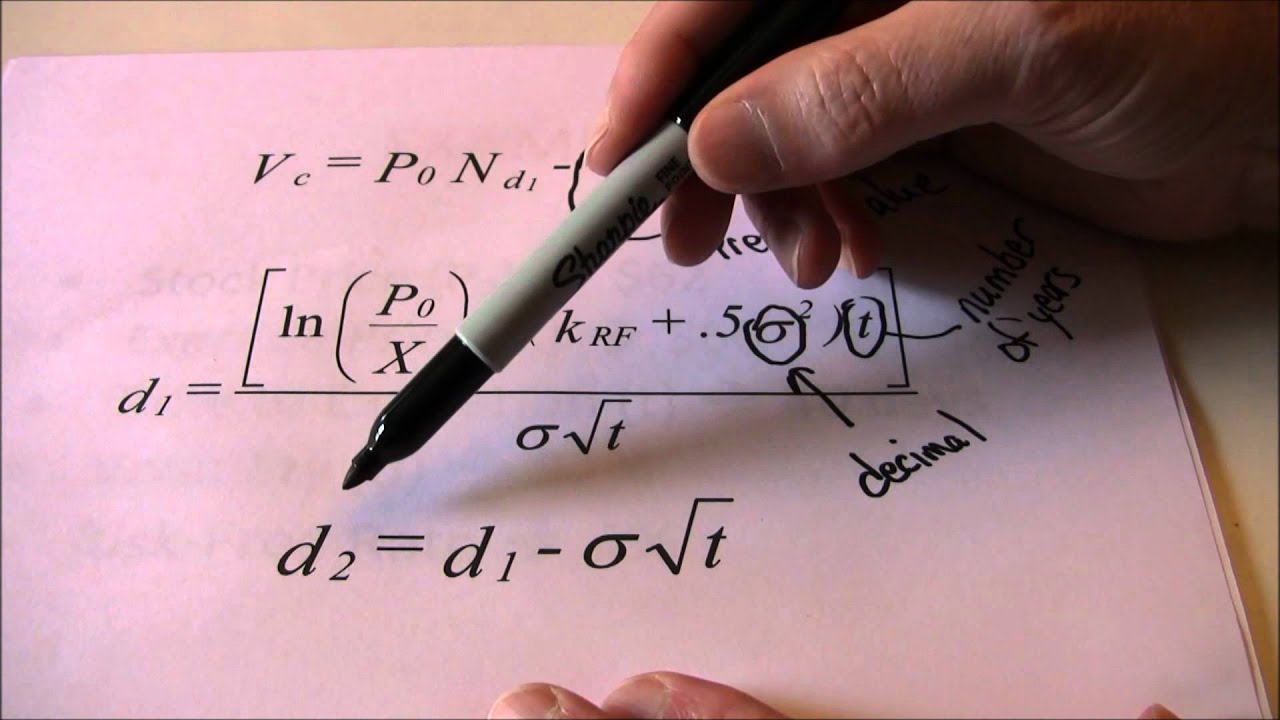

In this blog, I will demonstrate how to use python to calculate the price of a call option for the iShares 20+ Years Treasury Bond ETF (Ticker: TLT) using real time data from yfinance. Options are financial derivatives that provide the right, but not the obligation, to buy or sell an asset at a predetermined…

-

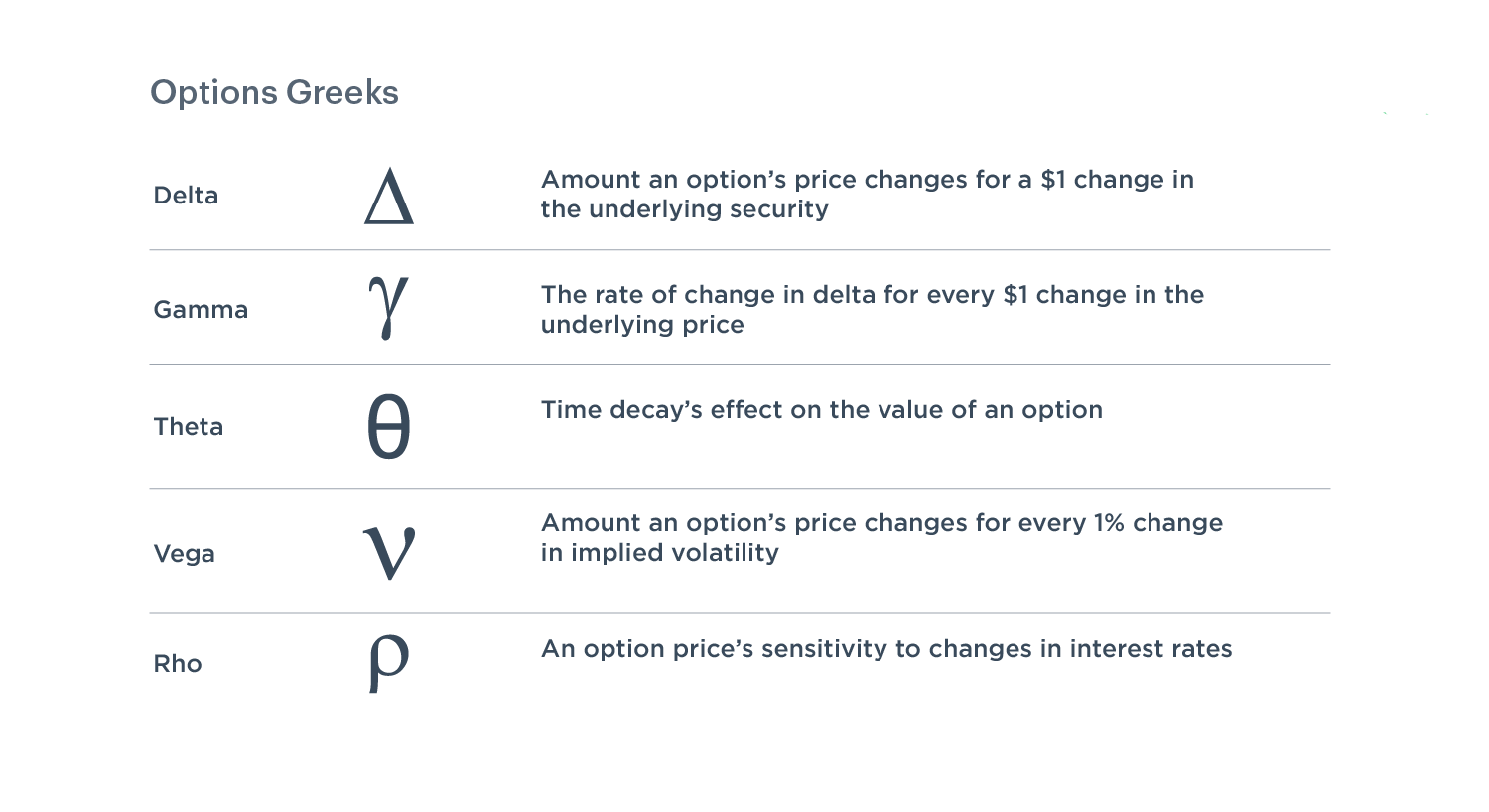

Option Greeks are a set of metrics that measure the sensitivity of an option’s price to various factors. They help traders and portfolio managers assess and manage the risks associated with options. Theta: Sensitivity to Time Theta measures the rate of change of an option’s price with respect to the passage of time (time decay).…

-

If monetary policy is not independent, the government may exploit inflation for vote gains, assuming unemployment in the short-run following the Phillips Curve. Policy Invariance (New classical macroeconomics) New classical macroeconomics affect norminal but not real variables Demand deviates from long-run supply only if prices are different from what is expected. The implication is that…

-

Ques 1: Derive the Black-Scholes equation for a stock, S. What Boundary conditions are satisfied at S = 0 and S = ∞? Ans: The evolution of the stock price St is given by: Since, under Black-Scholes, the model assumes no arbitrage exists, therefore, the mean level is set at the risk-free interest rate level.…

-

Option Greeks are a set of metrics that measure the sensitivity of an option’s price to various factors. They help traders and portfolio managers access and manage the risk associated with options. Delta: Sensitivity to Underlying Price Delta measures the rate of change of an option’s price with respect to changes in the price of…

-

IS-MP-PC model can be used to better understand the dynamic of Monetary Policy Dynamics. The model has three elements to it. Putting three elements together we can get the IS-MP-PC model. Substitutes Monetary Policy Curve into IS curve, you obtain the IS-MP curve: If beta > 1 then increase in inflation lead to higher increase…