Category: Option Strategies

-

Long Call: What does it do? It gives you the right (but not the obligation) to purchase a underlying stock at your quoted price within a period (before expiration date). This quoted price is the strike price. If the spot price (i.e.: current market price) goes above the strike price, then you make money by…

-

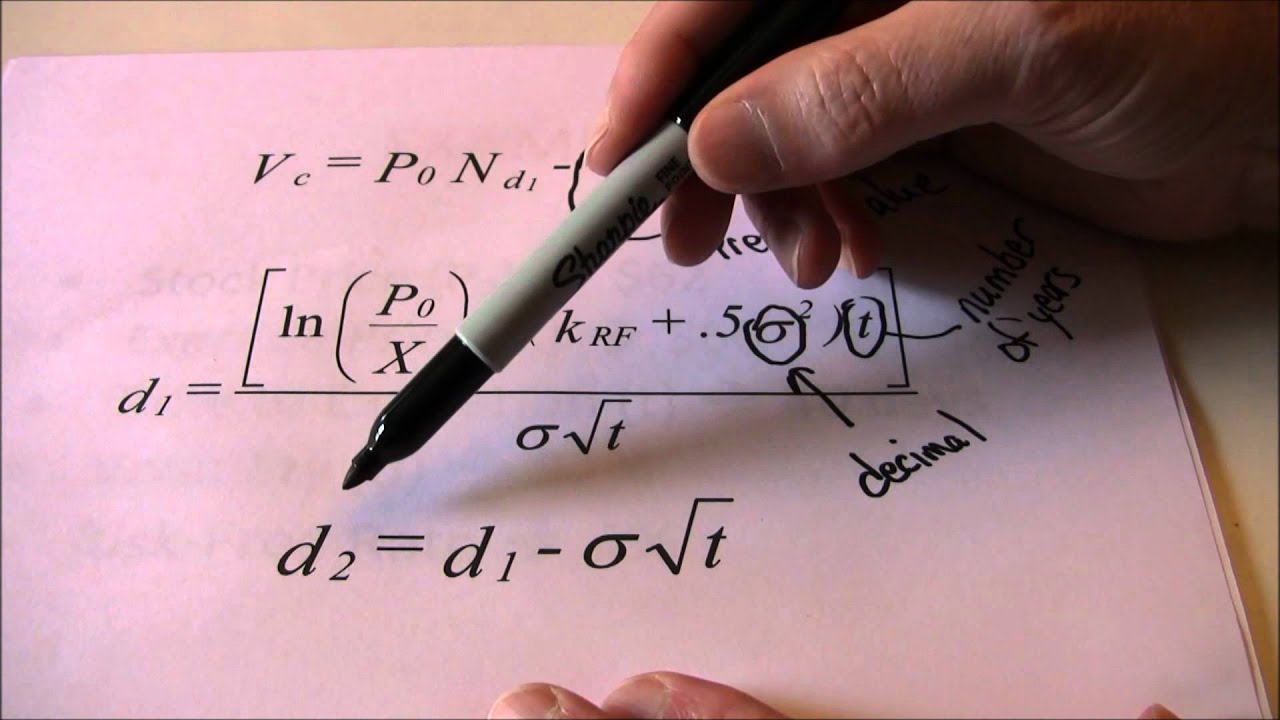

In this blog, I will demonstrate how to use python to calculate the price of a call option for the iShares 20+ Years Treasury Bond ETF (Ticker: TLT) using real time data from yfinance. Options are financial derivatives that provide the right, but not the obligation, to buy or sell an asset at a predetermined…

-

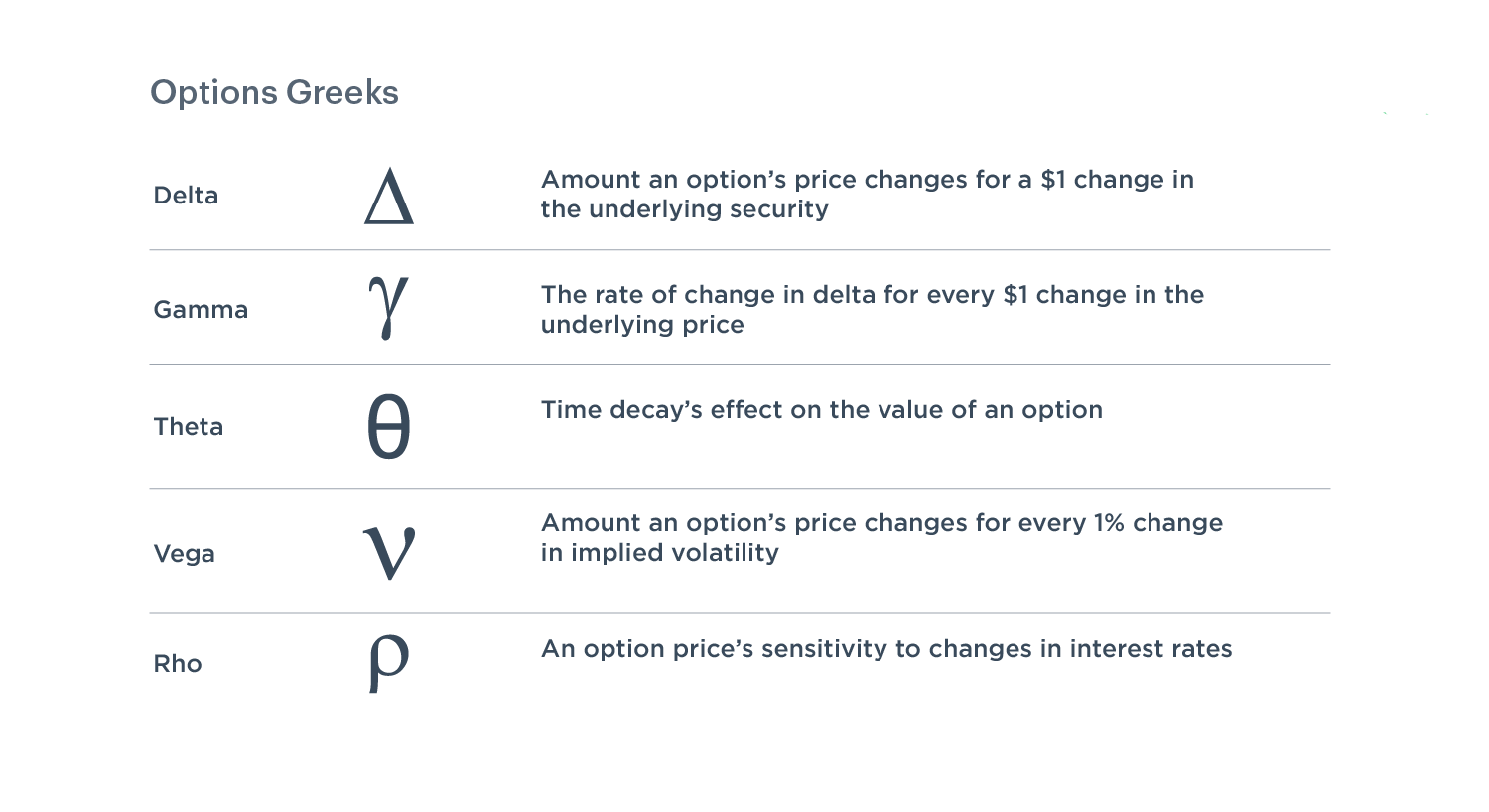

Option Greeks are a set of metrics that measure the sensitivity of an option’s price to various factors. They help traders and portfolio managers assess and manage the risks associated with options. Theta: Sensitivity to Time Theta measures the rate of change of an option’s price with respect to the passage of time (time decay).…

-

Option Greeks are a set of metrics that measure the sensitivity of an option’s price to various factors. They help traders and portfolio managers access and manage the risk associated with options. Delta: Sensitivity to Underlying Price Delta measures the rate of change of an option’s price with respect to changes in the price of…